|

Professor Anvari Taught manufacturing and industrial systems engineering courses at the University of Michigan for five years where he received his three engineering degrees, and as an adjunct professor he teaches project and cost management at local universities in the Washington DC area.� In his early career he worked at General Motors as a production engineer and later as an operations research and systems analyst at the cost and economic analysis center in Washington DC. Mort is currently the Director of Programs and Strategy at ASA (FM&C) and the Lean Six Sigma (LSS) deployment Director where he oversees process improvement initiatives, economic studies validation, cost benefit analysis, and risk and uncertainty analysis in support of major defense programs. Mort is Defense Acquisition University Level III Certified in Business Financial Management (BFM), and Business Cost Estimating (BCE). Mort has� received several professional awards that includes the 2006 DoD modeling and simulation award. In his public lectures, Mort stimulates cost culture debates among government and industry leaders and managers. Professor Anvari has repeatedly appeared on live television programs analyzing the political economy of the Middle East. |

|

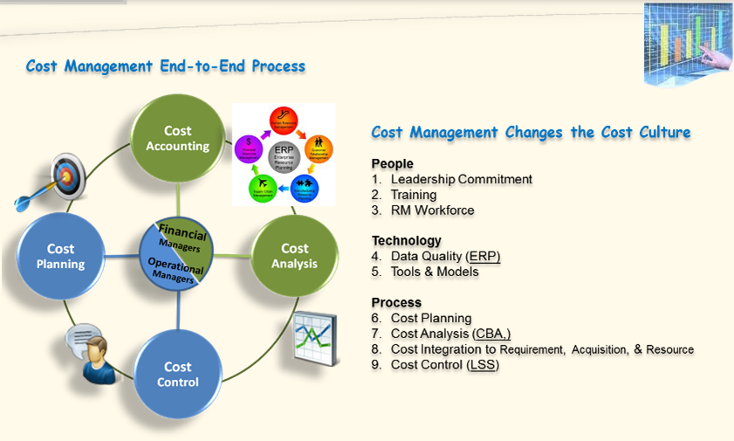

Cost management

Cost management is the process by which companies control and plan the costs of doing business. Individual projects should have customized plans for this process, and companies as a whole also integrate cost management into their overall business model. There is no single accepted definition for this term, because it has such broad applications and possible strategies. When properly implemented, this process will translate into reduced costs of production for products and services, as well as increased value being delivered to the customer.

For a company's management to be effective overall, cost management must be an integral feature of it. It is easiest to understand this concept if it is explained in the context of a single project. For instance, before a project is started, the anticipated costs should be identified and measured. These expenses should then be approved before any purchasing occurs. During the process of completing a project, all incurred costs should be noted and kept in a record of some kind, to help ensure that the costs are controlled and kept in line with initial expectations, to the extent that this is possible.

Taking this approach to cost management will help a company determine whether they accurately estimated expenses at first, and will help them more closely predict expenses in the future. Any overspending can also be monitored in this way, and either eliminated in future projects or specifically approved if the expense was necessary. Cost management cannot be used in isolation; projects must be organized and tailored with this strategy in mind.

Starting a project with cost management in mind will help to avoid certain pitfalls that may be present otherwise. If the objectives of the project are not clearly defined at first, or are changed during the course of the project, cost over-runs will be more likely. If costs are not fully researched before the project, they may be underestimated, thereby inflating the expectation of the project's success unrealistically. Construction projects are subject to their own particular challenges; these can include constraints in the form of laws and regulations that must be planned around.

If the project is completely and clearly defined, this will facilitate effective management of the costs it will incur. Effective cost management strategies will help a team deliver a finished project within the allocated budget, while also making it as valuable as possible to the company. There is always the possibility of unexpected costs, but preparation in the form of cost management will likely make them much easier to deal with when they occur.

Related Topics � Business Strategy � Quality Control � Budget Software � Business Plan Preparation � Project Management � Software Cost Control � Budget Form � Well Control � Business Process Software |

|

Mort Anvari |

|

Professor Anvari Taught manufacturing and industrial systems engineering courses at the University of Michigan for five years where he received his three engineering degrees, and as an adjunct professor he teaches project and cost management at local universities in the Washington DC area.� In his early career he worked at General Motors as a production engineer and later as an operations research and systems analyst at the cost and economic analysis center in Washington DC. Mort is currently the Director of Programs and Strategy at ASA (FM&C) and the Lean Six Sigma (LSS) deployment Director where he oversees process improvement initiatives, economic studies validation, cost benefit analysis, and risk and uncertainty analysis in support of major defense programs. Mort is Defense Acquisition University Level III Certified in Business Financial Management (BFM), and Business Cost Estimating (BCE). Mort has� received several professional awards that includes the 2006 DoD modeling and simulation award. In his public lectures, Mort stimulates cost culture debates among government and industry leaders and managers. Professor Anvari has repeatedly appeared on live television programs analyzing the political economy of the Middle East. |

|

Cost Management 101 |

|

� What are costs and why is managing costs important? |

|

� Army�s overall objectives |

|

� Change enablers to support Cost Management |

|

� The process of Cost Management and how it differs from Budget Management |

|

� Defining the various cost objects (which replace APCs/JONOs) |

|

�� Within a Cost Model, e.g. organizations, products, services, jobs, etc. |

|

� Understanding decision points of where to capture information |

|

� The difference between cost capturing, allocations, and assignment |

|

� Reflecting organizational structures |

|

� Replacing APC/JONO�s |

|

Cost Management Training |

|

� Understanding of why managing costs are important, |

|

�� Army�s overall objectives, the process of Cost Management, |

|

�� How it differs from Budget, and key cost terms |

|

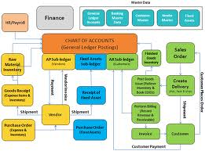

� Understanding of an ERP, |

|

� How to build a Cost Model, |

|

� Various cost objects within a Cost Model (e.g. organization, products, job orders) |

|

� Understanding of cost allocations/assignments, |

|

� How to choose which to utilize when, |

|

� How to evaluate the results of the assignments (Std. vs Actual), and |

|

� Rate creation |

|

� Understanding of the results of the Cost Model |

|

�� How various types of analysis and decisions are supported? |

|

Cost Management Certificate Course (CMCC) |

|

|

|

Army Cost Culture Initiative (Mort Anvari) |